Thank you for taking the time to check this out. It’s amazing the things we’ve seen in this industry, it’s about time you really understood what’s going on in your business.

As promised… Here is your guide on what to look for.

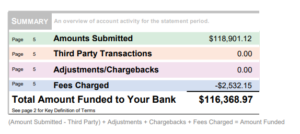

1.) OVERALL FEES / EFFECTIVE RATE

Somewhere on your statement, there should be a total of what you’ve been charged. This is the easiest way to find if you are paying too much. The quick formula that we use is, amount charged divided by amount submitted. In this example the customer is paying 2.17% Total Percentage with all fees included. If you do this and your percentage comes to higher than 2.5% you are likely paying too much.

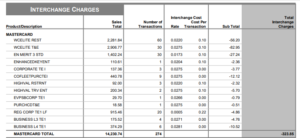

2.) INTERCHANGE FEES, DUES AND ASSESSMENTS

Undeniably the most confusing part of any statement. Interchange fees are set by Visa/Mastercard and the card issuing banks. Unfortunately there isn’t much that can be done with this set of fees, which typically add up to the highest cost to the business owner. There are however some things to look for. If your Interchange Fees aren’t listed and displayed in plain numbers and English, your current company might be inflating these costs. Most companies that inflate these costs are just trying to hide fees from the business owners and other representatives that don’t know what to look for. This is why dealing with someone that knows the industry and takes the time to explain your charges is the most important part of your processing account.

3.) DISCOUNT/PROCESSING FEES/AUTHORIZATION FEES.

These fees often carry different labels. Discount fee, processing fee, authorization fee, transaction fees. These are again very normal fees to see on your statement. Unlike most, these are the fees that can be negotiated and lowered. This is usually a small percentage that is added to the cost (interchange) of each card for services rendered. Again, talk with a company that knows their way around the processing industry to get these rates lowered. Seasoned representatives and companies have the best deals for processing fees due to the number of businesses they represent. Big stores have buying power, big processing companies also have buying power.

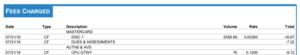

4.) MISC FEES

![]()

These one’s really get to me. Some miscellaneous fees are normal, some get out of control. There is a plethora of different fees that can be listed here. Some to keep an eye out for are, Statement fees (in excess of $5.00) PCI Fees, Annual fees, Batch fees (in excess of $0.35 each) Service charges, On-file fees. This list goes on and on.

5.) EQUIPMENT FEES

![]()

Typically listed along with your Miscellaneous fees. UNLESS YOU HAVE AN ARRANGEMENT TO PAY FOR EXPENSIVE EQUIPMENT THAT YOU WANTED OR NEEDED you shouldn’t be paying for simple equipment.

Thank you for taking the time to learn about this. The merchant processing industry gets a lot of bad remarks due to inexperienced representatives that haven’t been taught the right way to handle your business. Don’t fall victim to a company that doesn’t care! With several years in the industry, we’ve seen it all and would be happy to sit down and educate you on getting the best possible deal for your company!